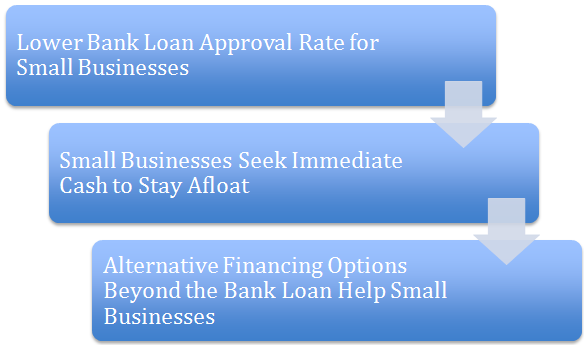

Businesses, particularly those small in size, rely on loans to thrive and prosper. Since 2007, lending regulations have become tighter resulting in the difficulty for small businesses to obtain loans from credit unions and banks. The small business community is working to stay afloat as loans continue to lag.

A recent report by the Biz2Credit Small Business Lending Index showed an increase by 4.3% from July to August in loan applications. Surprisingly, approvals by both big banks and credit unions decreased.